The DIY Investor’s Dilemma: Are You a Coder or an Architect?

In today’s world, taking control of your investments has never been more accessible. With a few clicks, you can build a portfolio, a powerful feeling for any DIY investor. This hands-on approach offers a sense of control and saves on fees, which is why so many smart, capable people choose to manage their own money.

But as your portfolio grows from a simple script into a complex system, a critical question emerges: Are you the person writing the code, or are you the computer architect designing the entire system?

Think about it. A coder focuses on a specific function, writing lines of code to execute a task. The computer architect, however, designs the entire system. They ensure all the components—hardware, software, and networks—work together efficiently and securely to meet a larger objective. This is the core of professional investment management. It’s not just about executing individual trades; it’s about building a cohesive, resilient financial system where every component works together to achieve your long-term goals.

This article explores the “architectural” work you might be missing-the holistic financial planning and long-term investment strategy that turns a collection of assets into durable wealth. We’ll examine the value of a financial advisor by looking at the hidden work that transforms good trades into a great plan.

The Architect’s Blueprint: What a Pro Designs Before a Single Trade is Made

Many DIY investors, driven by excitement, often start with the “what”—what stocks to buy or what platform to use. A financial architect, however, always begins with the “why.” Before a single dollar is invested, they design a comprehensive system blueprint that ensures every component of your financial life works in harmony. This blueprint is the foundation of a durable, long-term investment strategy.

Your Financial Operating System: Holistic Goal-Setting

Think of your financial goals as your personal operating system (OS). Your investments are just the applications that run on it. Without a robust OS, your apps might conflict, crash, or fail to achieve their purpose. A professional in investment management works with you to define this system. It goes beyond a vague goal like “retire comfortably.” It means building a plan to:

- Retire at age 62 with a specific after-tax income.

- Fund a child’s college education without derailing your savings.

- Optimize your employee benefits, like RSUs and ESPPs, as part of your total wealth.

This holistic financial planning process connects every investment decision back to a tangible, real-world outcome, ensuring your portfolio is built for your life, not just for the market.

System Optimization: Strategic Tax Design

It’s not about what you earn; it’s about what you keep. For a DIYer, it’s easy to focus on gross returns while overlooking “tax drag”—a processing leak that silently drains your portfolio’s power over time. A financial architect minimizes this drag through strategies like asset location.

This isn’t the same as asset allocation. Asset location is about placing certain assets in the proper accounts to maximize tax efficiency. For example, a professional will typically:

- Place tax-inefficient investments, like actively managed funds or taxable bonds, inside tax-advantaged accounts (your 401(k) or IRA).

- Place tax-efficient investments, like broad-market index funds, in taxable brokerage accounts to benefit from lower long-term capital gains rates.

This deliberate structure is a core part of wealth management. It can add significant value to your net returns over time—something easily missed when you’re focused only on buying and selling.

Your System’s Firewall: True Risk Architecture

A simple online risk questionnaire is like a default password—it offers basic protection but isn’t truly secure. A financial architect builds a multi-layered firewall by assessing risk from two critical angles:

- Your Capacity for Risk: Can your financial plan technically withstand a 20% or 30% market drop without failing?

- Your Composure for Risk: How will you emotionally handle that drop?

An advisor helps find your “best fit” asset allocation by balancing both the intellectual (IQ) and emotional (EQ) aspects of investing. Getting this wrong is a huge vulnerability; an allocation that looks good on paper but causes you to panic sell during market volatility is a flawed design. This firewall is designed to protect your portfolio from technical threats and from the costly emotional decisions you might be tempted to make.

Beyond the Build: The Hidden Dangers of DIY Maintenance

A brilliant system design is only half the battle. The real test comes during live operation, with its unexpected bugs, external threats, and the constant need for updates. For the DIY investor, this ongoing maintenance is often where the most critical—and costly—errors occur. Even the best-designed systems can fail without disciplined monitoring and maintenance.

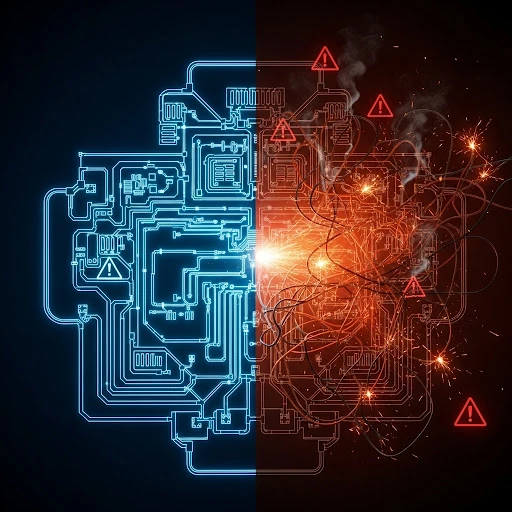

The Emotional Bug: Your Biggest System Vulnerability

The greatest threat to any investor’s portfolio isn’t a market crash; it’s the emotional reaction to it. Humans are hardwired to be susceptible to fear and greed, which can act like a recurring bug in our financial decision-making. This bug often leads to the classic mistake of buying high during periods of euphoria and selling low during a panic. These reactive decisions are some of the most significant hidden dangers of DIY investing, which we explore in more detail here.

This is where an advisor’s role as a behavioral coach becomes invaluable. An advisor acts as your 24/7 security monitoring service and debugger, providing the behavioral coaching needed to patch these emotional bugs. During periods of market volatility, they serve as an “emotional circuit breaker.” According to Vanguard’s “Advisor’s Alpha” research, this guidance can prevent significant wealth destruction, with behavioral coaching alone potentially adding up to 200 basis points (or 2%) or more in net returns.

The Time Tax: The Full-Time Job You Didn’t Sign Up For

Proper investment management isn’t a background process you can run on low power. It’s a resource-intensive application that demands constant attention—a hidden “time tax” on your life. To truly replicate the work of a professional, a DIY investor would need to manage:

- Proactive Rebalancing: As markets shift, a portfolio drifts from its target asset allocation. A professional systematically rebalances by selling high-performing assets and buying underperforming ones—a counter-intuitive and emotionally difficult task for many.

- Tax-Loss Harvesting: An advisor constantly scans your portfolio for opportunities to sell investments at a loss to offset taxable gains elsewhere. To be most effective, this requires daily monitoring and a deep understanding of tax rules, which is nearly impossible for a DIYer with a full-time career.

- Ongoing Research: The world is constantly changing. A professional dedicates their career to monitoring economic trends, market conditions, and tax law changes so you don’t have to.

By delegating this “processing,” you free up your own “CPU”—your time and mental energy—to focus on what you do best: your career, your family, and your life.

Upgrade Your Role from Coder to CEO

As we’ve seen, successful investment management is far more than just writing good code. It’s about architecture, system maintenance, and high-level strategy. The skills that help you start your investing journey aren’t always the same ones that will help you see it through successfully to your goals.

The journey of a successful investor often involves an evolution in their role. While you may have started as the hands-on “coder,” your growing wealth demands a new position: CEO of your financial life.

What does a smart CEO do? They don’t spend their days debugging code or running server maintenance. They set the vision and define the goals, then hire experts to build and manage the systems that achieve that vision.

Hiring a financial advisor is a strategic delegation. You’re bringing on a personal Chief Financial Officer (CFO) for your wealth—an expert who acts as your lifetime financial navigator, guiding you through every stage. You can read more about this comprehensive guidance here. This expert will:

- Design your financial blueprint (holistic financial planning).

- Optimize your system for peak performance through strategies like tax-efficient rebalancing and tax-loss harvesting.

- Protect your system from your biggest vulnerability—emotional decision-making—through disciplined behavioral coaching.

You’ve already proven you have the drive to build wealth. The next step is to leverage your success by putting a professional in charge of managing its complexities, freeing you to focus on what matters most.

If you’re ready to upgrade your role from coder to CEO, we invite you to schedule a complimentary portfolio review. Let’s look at the system you’ve built and explore how a professional architect can help you scale it for the future.