The Challenge of Financial Complexity: Finding Your Navigator

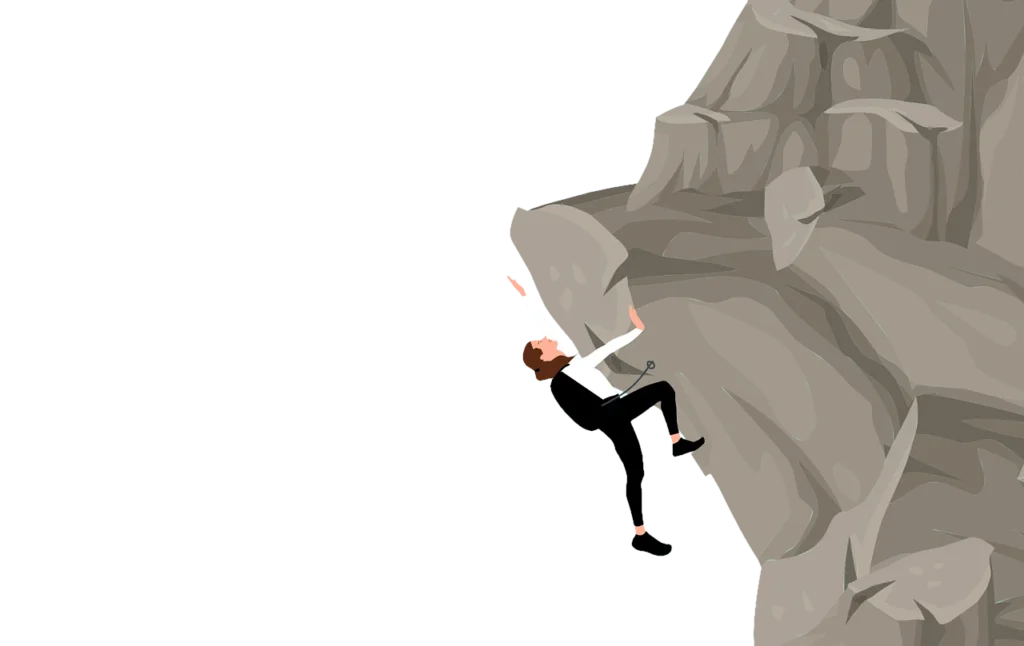

Navigating today’s financial world isn’t easy. As we explored in our previous article, “The Hidden Dangers of DIY Investing: Why Going Solo Can Cost You More Than Fees,” going it alone has many challenges. Markets are complex. Our own emotions can trip us up. And there’s so much more to financial planning than just picking stocks.

Understanding these difficulties is the first step. The next is finding a strong, reliable solution.

This is where a dedicated wealth advisor steps in. We become your key partner. We help you build and adapt a strong financial plan for your whole life. Our main goal is to make your hard-earned money work for you. This happens through all market changes, every stage of your life, and any unexpected events. When facing the many needs of wealth management, a professional guide can make all the difference.

Table of Contents

- The Wealth Advisor’s Advantage: A Holistic and Evolving Financial Blueprint for Lifetime Security

- Navigating Life’s Inevitable Changes: Your Wealth Advisor as Your Constant Financial Guide

- Seeking Professional Financial Guidance: Don’t Wait Until Your Savings Are at Risk

- Investing in Your Future, Securely and Strategically with a Trusted Partner

The Wealth Advisor’s Advantage: A Holistic and Evolving Financial Blueprint for Lifetime Security

The world of DIY investing often focuses only on “how to pick stocks.” But a wealth advisor’s approach is very different. We are your essential strategic partner, not just someone who picks stocks. We want to empower you. We do this by expertly managing your entire financial life. Our promise is to help you create a strong, full financial plan. This plan changes as your life changes.

Understanding Your Unique Financial DNA: It All Starts with a Deep, Personalized Discovery

Before we make any investment choices, a true wealth advisor starts with a deep, personal discovery process. This isn’t just about your money now. It’s about truly understanding who you are financially. This includes:

- Your Core Goals: What do you want your money to do? Do you dream of a comfortable retirement, fully paying for your children’s college, starting a new business, or leaving money to charity? Every financial plan we make is unique. It’s built just for your goals.

- Your Core Values: What’s important to you? Do you care about the environment, social good, or good company practices (ESG investing)? We make sure your investments match your beliefs.

- Your Fears and Concerns: What worries you about your financial future? Knowing this helps us plan ahead.

- Your Family Situation: How does your family affect your money needs and plans?

- Your True Risk Tolerance and Capacity: We go beyond simple questions. We look at how you truly feel about market ups and downs. We also see how much risk you can really take over time. This makes sure your plan is right for you.

This personal approach ensures your financial plan exactly matches your life, your wishes, and your goals. We know that financial needs and strategies are always changing. They grow with you from early career, through mid-life, into retirement, and beyond.

The Pillars of a Resilient, Advisor-Guided Portfolio

Once we truly understand your financial situation, we focus on building an investment portfolio. This portfolio is made for strength and growth throughout your life. It goes far beyond simply deciding “how to invest in stocks.”

Beyond Basic Investments: Our Strategic Portfolio Approach

- Smart Asset Allocation: We build a truly varied portfolio. It includes different types of assets like stocks, bonds, and other less-connected investments. We match this mix to your personal risk tolerance, your timelines for each goal, and your main financial aims. This careful mix is your first protection against unpredictable market changes.

- Active Risk Management in Investing: We don’t just hope for the best. We actively find, check, and lower different kinds of investment risk that a DIY investor might miss:

- Market Swings: We help protect against big market movements.

- Rising Costs: We guard your buying power against inflation.

- Changing Interest Rates: We manage how interest rate changes affect your bonds.

- Outliving Savings: We plan so your money lasts if you live longer than expected.

- Easy Access to Money: We make sure you can get your funds when needed without losing too much value. We use methods like careful mixing of assets, smart hedging when needed, and regular adjustments. This active management helps control your exposure and protect your money in uncertain markets. We also test portfolios against different economic situations. This helps ensure they are strong and ready for unexpected challenges.

- Using Smart Technology (Portfolio Management Systems): We use modern tools like advanced Portfolio Management Systems. These are not replacements for our human knowledge. Instead, they are powerful tools that make us better. They help us with huge data analysis, complex modeling, and efficient portfolio handling. The key point is that the wealth advisor remains the smart human behind the machine. We give the big-picture guidance, understanding, and judgment. This ensures technology always serves your best interests, not just a standard approach.

- Considering Your Values (ESG Investing): Some clients care strongly about values-based investing. For them, we carefully include Environmental, Social, and Governance (ESG) factors when building their portfolio. This means finding companies with strong ESG practices. This helps make sure your investments match your personal beliefs and what you want for society. And we still work hard to meet your main financial goals.

The Comprehensive Financial Ecosystem: More Than Just Investment Management

A truly strong and effective financial plan goes far beyond just managing investments. It covers all parts of your financial life. A wealth advisor offers expertise across this wide system:

- Better Tax Planning: We use smart tax planning to help lower your taxes on investments, income, and your future estate. This includes using things like tax-loss harvesting. We also put assets in the right accounts (taxable, tax-deferred, tax-free). And we talk about options like Roth conversions.

- Smart Insurance & Risk Control: We find and fix weak spots in your financial plan. We suggest the right insurance for life, disability, and long-term care. This is a key safety net. It guards your income, money, and overall financial health from unexpected events.

- Good Debt Management & Cash Flow: Your wealth advisor helps add smart ways to lower debt into your overall plan. This stops high-interest debt from quietly eating away at your investment gains. We also help you manage your money coming in and going out. This means efficient saving and smart spending.

- Lasting Retirement Income: As you near or enter retirement, our focus changes. We move from just growing money to planning for steady income. This helps ensure your savings last throughout your retirement years. It adjusts for rising costs and healthcare needs.

Navigating Life’s Inevitable Changes: Your Wealth Advisor as Your Constant Financial Guide

Life is always changing. It’s a journey with planned events and surprises. A fixed investment plan, managed only by you, just can’t keep up. A dedicated wealth advisor is like your constant financial GPS. We give steady, expert guidance through every big life event. This is true whether it’s planned or not.

Proactive Financial Planning for Life’s Major Milestones:

We help you get ready for and smartly add financial plans around key life moments:

- Marriage or Partnership: We guide you through combining money and setting shared goals.

- Children and Family Growth: We plan for college savings. We help set up trusts for kids. We review and adjust life insurance needs for your growing family.

- Big Career Changes or Businesses: We adjust your financial plan for changing income. We manage stock options smartly. We give expert advice on planning for your business future.

- Homeownership or Big Purchases: We advise on smart ways to pay for things, help manage and prioritize debt, and smoothly add these big assets to your total worth and long-term plan.

Adapting to Unexpected Turns with Professional Calm and Expert Insight:

Life, however, often throws unexpected curveballs. During these challenging times, a wealth advisor provides invaluable, objective, unemotional guidance:

- Job Loss or Disability: We help you create strong emergency funds. We plan for income if you can’t work. This helps ensure financial stability during uncertain times.

- Market Downturns and Ups & Downs: We act as a steady anchor. We help prevent quick, emotional decisions like panic selling, which can lead to big losses. Instead, we help you understand the long-term view.

- Health Challenges: We help you plan for possible healthcare costs. We explain complex insurance options. We help you understand long-term care choices. This lowers a big source of money worry.

- Inheritance or Windfall: We give expert advice on adding sudden money into your plan. This helps maximize its long-term benefits and matches your overall goals.

- The Important Part of Regular Reviews: Your Financial Plan is a Living Document

Your financial plan is not a “set it and forget it” paper. It’s a living guide that needs constant care, careful checking, and active changes. We have regular meetings and check performance. We constantly adjust plans based on market shifts, changes in your life, and new goals. Your wealth advisor is your trusted partner. We help keep you disciplined and on track, making sure your investments always match your life’s path, year after year, for decades.

Seeking Professional Financial Guidance: Don’t Wait Until Your Savings Are at Risk

Many people only get professional financial advice after they’ve made a big, costly mistake. Or when their money situation becomes too complex to handle. But true financial wisdom means seeing the “tipping point” and getting professional help before expensive errors happen.

When DIY Investing Becomes Too Risky:

Think about getting professional help if any of these sound like you:

- Your money situation feels too complex for you to handle well on your own.

- Your emotions (fear, greed) start to control your investment choices, often leading to regrets.

- You spend more time worrying about your money than enjoying your life.

- You have big life changes coming, like marriage, kids, a new job, or retirement.

- You feel unsure about taxes, estate planning, or advanced risk management.

The “Prevention is Better Than Cure” Principle: Safeguarding Your Financial Health

In personal finance, preventing problems is truly better than fixing them. Getting help from a skilled and ethical financial professional early can stop costly mistakes. It builds a stronger, more stable base for your future wealth. The cost of professional financial advice is an investment, not just an expense. Especially when you compare it to the significant financial losses that can happen from going it alone. Imagine the peace of mind and less stress you’ll feel. Knowing your savings are managed with due diligence, careful oversight, and a full, long-term plan for your whole life.

What to Look for in a Wealth Advisor Who Will Protect Your Financial Future:

When you decide to find a wealth advisor, look for key signs of a trustworthy and capable partner:

- Fiduciary Duty: This is most important. Make sure any advisor you consider is legally bound to act only in your best financial interest. Your needs come first.

- Experience and Credentials: Look for professionals with a trusted title like CFP® (Certified Financial Planner) or RIA (Registered Investment Advisor). These show high training, ethics, and an understanding of financial planning.

- Holistic Approach: Choose an advisor who understands and will help with all parts of your financial life. This goes beyond investments to include discussions on taxes, estate planning, and insurance.

- Clear Fees: Demand to know exactly how your advisor is paid. Understand all fees. This helps avoid any hidden costs or conflicts of interest.

- Good Connection and Clear Talk: You need to feel comfortable and understood by your advisor. They should explain complex money ideas simply. This builds trust and respect.

Don’t make another choice that could put your savings at risk. Talk to a qualified wealth advisor. We can help you build a strong financial map. We manage market risks expertly. We help ensure your investment journey leads to potential for consistent growth, strong security, and deep peace of mind, not regret.

Investing in Your Future, Securely and Strategically with a Trusted Partner

Deciding to work with a professional wealth advisor is a powerful investment in your future. It gives you more than just smart investment help. It provides a full, changing financial plan made just for your life and goals. This partnership brings great peace of mind. It lowers money stress. It gives you strong confidence that you are on a disciplined path to reach all your long-term money goals.

By choosing a dedicated wealth advisor, you get a steady, lifelong partner. They are committed to your lasting wealth and strong security. This gives you freedom to focus on what matters most in your life – your family, your career, your passions. All while your carefully managed money works hard, smartly, and strategically for you. This helps protect your financial future for generations. Don’t leave your money future to chance. Make the smart choice to invest in expert guidance today.

Schedule Your No-Obligation Free Consultation Today.