Why the 60/40 Portfolio Is No Longer Enough

For decades, the standard investment advice—allocating 60% of a portfolio to stocks and 40% to bonds—served as a reliable foundation for building wealth. The simplicity of the 60/40 Portfolio was its strength: when stocks fell, bonds typically rose, acting as a crucial counterbalance.

But the financial world has fundamentally shifted. Today, relying solely on this outdated model exposes high-net-worth tech professionals to risks they can no longer afford to ignore:

Table of Contents

- Why the 60/40 Portfolio Is No Longer Enough

- Buffer ETFs: Managing Volatility with Precision

- Digital Assets (Crypto): The Small, Strategic Allocation

- Portfolio Construction: The New Asset Allocation

- Why You Need a Modern Manager

DISCLOSURE: This material is for informational purposes only and is not intended to serve as a substitute for personalized investment advice or consultation with a professional tax advisor. Investing involves risk, including the possible loss of principal. Investing in Buffer ETFs and Digital Assets involves specific risks outlined below.

The Failure of Traditional Defense

- Rising Correlation: In today’s high-inflation, high-interest-rate environment, the historic inverse relationship between stocks and bonds has weakened. In many modern market downturns, stocks and bonds are falling simultaneously, eroding the core defensive benefit of the 60/40 model.

- Unique Tech Professional Risks: Your wealth profile is unique. You face immense exposure to concentrated single-stock risk (from RSUs, ESPPs, and options), and your high income means you demand exceptional tax efficiency and aggressive growth. The 60/40 model is too static and generalized to manage these specialized risks.

The Solution: A Modern, Defined-Risk Approach

Your portfolio requires tools designed for precision risk management, not broad approximations. Moving beyond the 60/40 model means actively incorporating assets that fulfill specific mandates: managing volatility, protecting principal, and seeking growth with defined limits. This guide will show you how we construct a modern portfolio using Buffer ETFs for sophisticated downside protection and Digital Assets for strategic, asymmetric growth.

Buffer ETFs: Managing Volatility with Precision

For tech professionals navigating the complex transition from concentrated company stock to a diversified portfolio, Buffer ETFs (Defined Outcome ETFs) offer a unique risk management tool.

What They Are

A Buffer ETF is an exchange-traded fund designed to deliver a defined range of investment outcomes over a specific period, typically one year. They achieve this using a structured strategy of derivative contracts known as FLEX Options based on a common index like the S&P 500 or the Nasdaq 100.

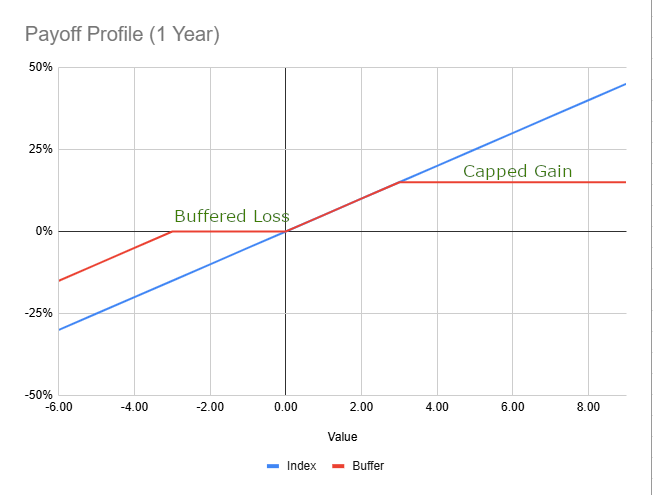

The central concept is a clear trade-off: downside protection in exchange for capped upside potential.

The Core Trade-Off: Buffer vs. Cap

When your firm incorporates a Buffer ETF, the client gains two specific parameters for the outcome period:

- The Downside Buffer (Protection): This is the maximum loss the ETF is designed to absorb. For example, a 15% buffer means that if the underlying index drops 25% over the period, the investor’s loss is limited to 10% (the loss beyond the 15% buffer).

- The Upside Cap (Limitation): This is the maximum gain the investor can achieve in that same period. If the cap is 10% and the index gains 20%, the investor’s return is limited to 10%.

For information purposes only. 1

When an RIA Uses Buffers

We only use Buffer ETFs tactically, specifically in scenarios involving managing transitions and risk aversion:

- De-Risking Transition Funds: Using a Buffer ETF allows us to immediately put newly liquidated company stock cash to work in the market, capturing some upside while protecting the principal from a sudden, sharp market correction.

- Behavioral Hedge and Peace of Mind: They offer peace of mind for clients with a large sum of money for a near-term goal (1-3 years), preventing them from panicking and selling all equity during market dips.

The Critical Role of Timing and Monitoring

The defined outcome only applies if you buy the ETF on its start date and hold it for the entire outcome period. Your RIA firm continuously monitors these cap and buffer reset dates, determining the optimal entry points and ensuring the allocation still fits your evolving financial plan.

Digital Assets (Crypto): The Small, Strategic Allocation

Digital Assets offer the potential for asymmetric returns—high potential reward with a controlled exposure to loss. For tech professionals, a small, defined allocation is a natural part of a forward-looking investment strategy.

The Role in a Modern Portfolio

We view digital assets not as speculative trading vehicles, but as a strategic portfolio component for two key reasons:

- Portfolio Diversification: Historically, digital assets have maintained a low correlation with traditional asset classes like stocks and bonds, providing a hedge against the performance of mainstream markets.

- Asymmetric Growth Potential: While volatile, a small allocation provides exposure to a rapidly evolving technology sector and can provide outsized returns that compensate for the small allocation.

How Your RIA Manages Digital Asset Exposure

Due to their extreme volatility and unique market structure, digital assets require the highest level of caution and control.

- Risk-Budgeted Allocation: We strictly limit the allocation to a small, defined percentage of your overall portfolio (typically 1% to 5%)—capital allocated from your portfolio’s highest-risk budget.

- The Right Vehicle and Custody: We prioritize the use of regulated, public market vehicles, such as Spot Bitcoin ETFs, for ease of management and to avoid the security and custodial risks associated with direct wallet ownership. Using these regulated vehicles also simplifies the back-office process, as the fund custodian handles the underlying tax reporting (e.g., 1099s).

- Controlling Exposure: We manage the process compliantly, ensuring the allocation remains within its risk budget and integrates seamlessly with your broader financial plan.

Portfolio Construction: The New Asset Allocation

Our strategy replaces simple binary allocations with risk-defined blocks designed to fulfill specific portfolio functions, moving beyond the 60/40 model.

| Portfolio Block | Allocation (Revised Range) | Primary Function | Tools Used by Your RIA |

| Core Growth | 40% – 60% | Drives long-term, inflation-beating returns. | Low-cost, globally diversified ETFs/Mutual Funds. |

| Defensive Income | 15% – 35% | Provides liquidity and non-correlated income. Used tactically based on client’s timeline. | High-quality, short-duration bond ETFs and Cash equivalents. |

| Defensive Buffer | 10% – 20% | Manages downside risk and protects principal from moderate corrections (up to the buffer amount). | Defined Outcome (Buffer) ETFs. |

| Asymmetric Growth | 1% – 5% | Provides potential hedge against traditional market risks; low correlation. | Regulated Digital Asset ETFs (e.g., Spot Bitcoin ETFs). |

The Value of This Structure

- Intentional Risk Budgeting: The small, high-risk allocation to Digital Assets is offset by the defined downside protection provided by the Buffer ETFs, creating a balanced overall risk profile.

- Addressing Tech Concentration: This structure gives us a dedicated place to place funds realized from the sale of concentrated company stock, allowing you to transition into the market confidently.

- Ongoing Management: This modern portfolio requires constant oversight—from monitoring Buffer ETF reset dates to rebalancing the risk allocation—expertise that a professional advisor can provide.

Why You Need a Modern Manager

The days of simply buying a few mutual funds and letting them ride are over. The sophisticated financial landscape demands a proactive, specialized approach.

Successfully integrating tools like Buffer ETFs for risk mitigation and strategic Digital Asset allocations for growth requires continuous monitoring, tax efficiency, and behavioral discipline. These are complex, time-intensive tasks that require the fiduciary expertise of a specialized RIA. Don’t let an outdated portfolio strategy manage your sophisticated income.

- Does not represent actual fund performance. Intended to illustrate the return profile the investment objective seeks to achieve relative to an Index. Illustration does not account for fund fees and expenses. ↩︎