If your finances feel too complex to manage on the side, it’s time to stop doing everything yourself. A coordinated financial plan helps you coordinate investments, taxes, and planning so you can focus on your life—while your money follows a clear, resilient path.

Most high-earning professionals reach a point where their financial life becomes too big and too complex to manage in spare moments. The spreadsheets get longer. The tax questions get heavier. Investments start pulling in different directions. And even though you’ve built a successful career through skill and discipline, managing your own finances starts to feel like a second job — one you never signed up for.

That’s the moment when many people realize something important: We don’t build wealth by doing everything ourselves. We build it by coordinating everything that matters.

A financial advisor doesn’t take over your life or control your money. Instead, the right advisor becomes your financial navigator — someone who helps you move from the role of “hands-on coder” to the role you’ve actually earned: CEO of your financial life.

This shift is what creates real wealth resilience. It’s what turns scattered decisions into a system that works. And it’s what frees you up to focus on your career, your family, and the future you want — not the paperwork that gets in the way.

Why DIY Money Management Eventually Breaks Down

DIY investing usually starts with good intentions. You want to understand your money. You want to be responsible. And early on, when things are simple, it feels manageable.

But financial complexity doesn’t grow in a straight line — it grows in layers.

A salary becomes a salary plus RSUs.

A simple IRA becomes a taxable account, a rollover, and a backdoor Roth.

A mortgage becomes a second property, a rental, or a refinance question.

A basic insurance plan becomes a real risk conversation when kids or aging parents enter the picture.

Each layer adds decisions. And each decision affects the others in ways that are easy to miss when you’re juggling everything alone.

You’re making financial decisions one at a time, but their impact happens all at once.

A financial advisor’s first job is to remove that fragmentation.

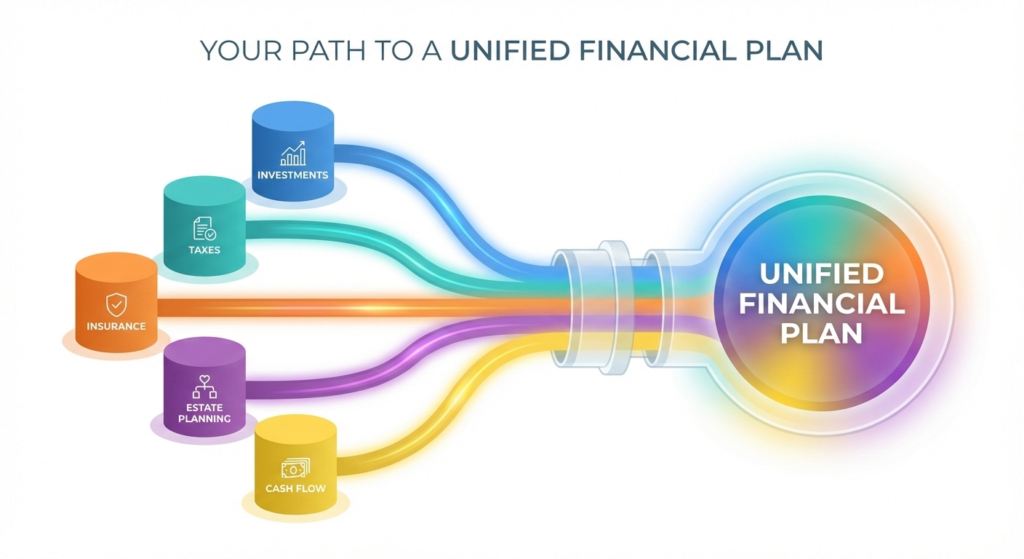

The Power of a Unified Financial Picture

Most people manage their money in separate buckets — investments, taxes, insurance, estate documents, savings, and debt — all siloed in different places.

Each bucket tells you one piece of the story. But none of them show you how the pieces fit together.

A financial advisor pulls everything into a unified view. When you see the whole system at once, patterns emerge. Opportunities appear. Conflicts become clear.

This coordination is the foundation of long-term wealth.

It’s not about finding the perfect investment.

It’s about making sure every decision supports the next one.

From Overworked Manager to CEO of Your Finances

Managing your finances without help is like building a house without a general contractor. Even if you know what you want, you’re still left coordinating electricians, plumbers, roofers, inspectors, and permits.

It’s not that you can’t do it — it’s that you shouldn’t have to.

A financial advisor is the general contractor for your financial life. You set the goals. You define the vision. Your advisor coordinates the specialists — your CPA, attorney, insurance professional, and lender.

This doesn’t reduce your control. It increases your clarity.

You move from managing everything to leading everything.

That’s the advisor solution: you make the strategic decisions, and your advisor makes everything work together.

The Behavioral Support You Don’t Realize You Need — Until You Have It

Even the smartest investors are still human, and humans don’t make great financial decisions under pressure.

Fear during market drops.

Excitement during bull runs.

Regret after missed opportunities.

Stress when headlines turn scary.

A financial advisor gives you something you cannot give yourself: a pause.

A cooling-off moment.

A second perspective.

A checkpoint before an emotional decision.

This pause often protects your plan from the mistakes you’d regret later. It’s one of the strongest nudges toward long-term success.

Why Life Transitions Demand a Guide — Not Just a Spreadsheet

A financial plan isn’t a one-time project. Life changes constantly, and each change rewrites your financial structure.

A new job brings new benefits and new taxes.

A baby brings new insurance needs and new planning responsibilities.

An inheritance brings new complexity and new risks.

Retirement brings a complete shift in income, taxes, and risk tolerance.

Spreadsheets can track the numbers.

A financial advisor helps you understand the impact.

This is where the navigator role becomes essential. Advisors don’t just build plans — they adjust them, continually and intentionally.

A Resilient Portfolio Starts With Understanding You — Not the Market

Most DIY investors think risk is about what the market might do. But real risk is about what you can handle.

A financial advisor helps you understand your personal risk tolerance, the amount of risk you actually need, and how your portfolio should evolve over time.

The goal isn’t to avoid volatility.

The goal is to avoid abandoning your plan when volatility arrives.

A resilient portfolio supports your life — not just your investments.

The Real Value: A Financial System Built Around Your Life

When your financial life is coordinated, everything becomes clearer.

You know where you stand.

You understand your decisions.

You stop guessing.

You stop feeling like something important is slipping through the cracks.

Clarity lowers stress.

Structure builds confidence.

Confidence supports long-term success.

That’s the advisor solution — a financial system that fits your life instead of fighting it.

How to Know When It’s Time to Work With an Advisor

You may be ready for an advisor if:

- your finances feel scattered

- your decisions feel disconnected

- your wealth has grown and so has your complexity

- taxes and planning feel overwhelming

- your time is too valuable to spend managing everything

- you want a partner who coordinates the entire financial team

- or you simply want a more confident, organized future

You don’t need chaos to hire an advisor.

You just need the desire for something better.

Becoming the CEO of Your Financial Life

You’ve built your career by focusing on your strengths — not by doing every job yourself.

Your financial life deserves the same approach.

A financial advisor becomes the navigator who keeps you on course, the general contractor who coordinates the moving parts, and the partner who helps you make decisions with confidence.

If you’re feeling the strain of managing everything alone, it may be time to step into your true role: CEO of your finances — with a system designed to support you, not overwhelm you. For a detailed look at the financial costs of managing your wealth alone, read our guide on The Hidden Dangers of DIY Investing